Latest. Updates, News

& Thoughts

The UK remains one of the strongest markets globally for high-growth businesses. According to the British Business Bank’s Small Business Equity Tracker 2025, smaller companies raised around £10.8bn of equity investment in 2024, making it one of the highest years on record despite a tougher macro backdrop.

But beneath that headline, the geography of investment is still heavily skewed.

The report shows that London-based companies account for less than half of all equity deals, yet still attract the majority of total investment by value. In simple terms, most venture capital is still competing for deals inside the M25, while large parts of the country remain comparatively under-served.

At Haatch, we think that imbalance creates opportunity.

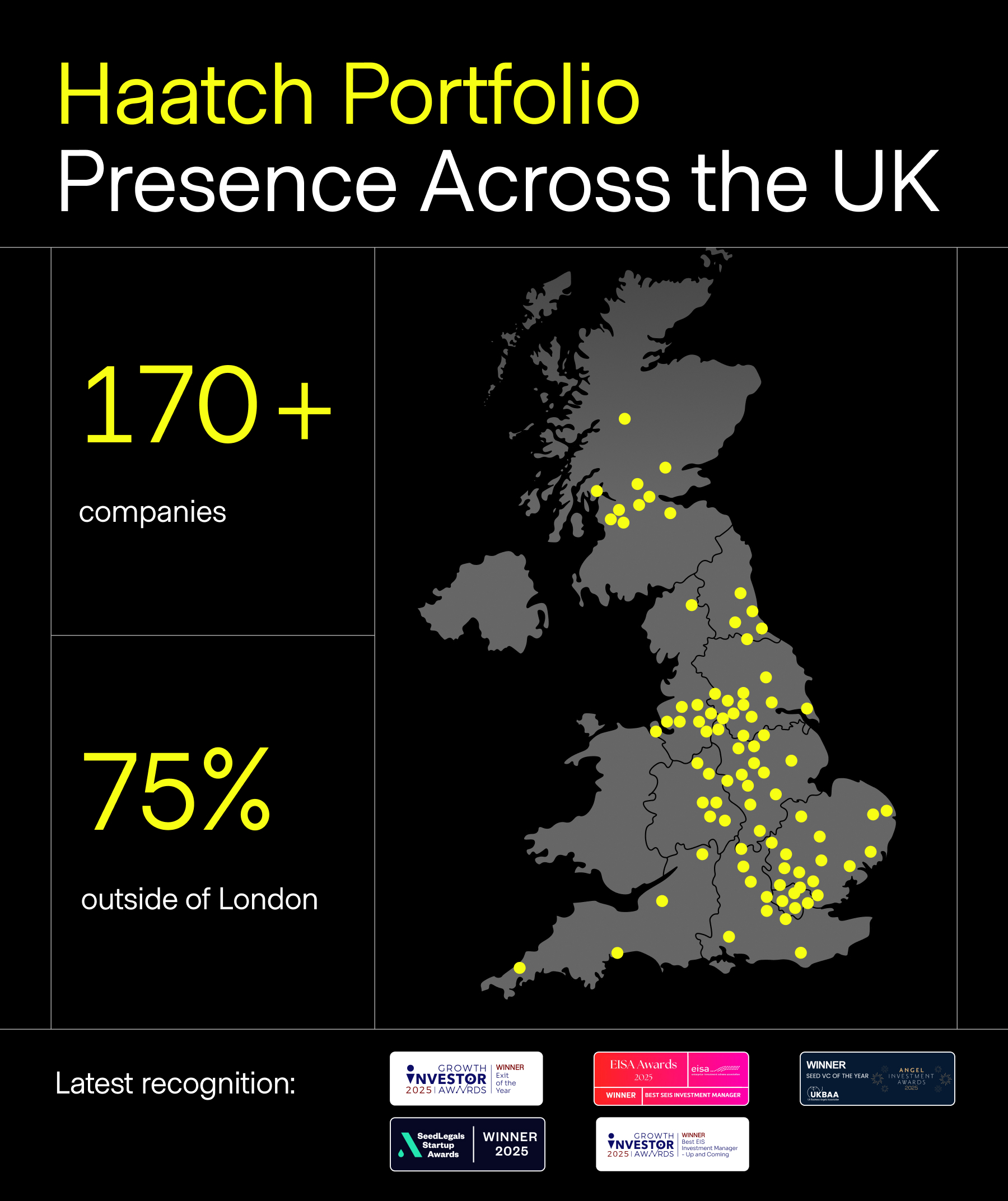

A map of our portfolio tells the story clearly: dots spread across the nations and regions of the UK, not just clustered around London. We’ve backed founders in cities and towns where competition for deals is lower, valuations can be more rational, and local ecosystems are rapidly maturing.

However, regional focus alone isn’t enough to build a differentiated venture strategy. The real edge comes from combining that focus with more capital firepower.

That’s where our agreement with the British Business Bank comes in.

Alongside Haatch’s own capital, we have access to significant co-investment:

- Up to £20 million of co-investment alongside Haatch into every company we invest in

- An additional £7 million dedicated to co-investing in syndicate deals we partner on, with first refusal on those opportunities

For founders, this means stronger balance sheets earlier. We can support larger rounds at the outset, giving companies a healthier cash runway and more room to execute before needing to raise again. In a market where round sizes have normalised and investors are more selective, that time matters.

For our investors, it means each pound of committed capital is effectively leveraged. We can:

- Lead or anchor rounds with larger cheques than our fund size would normally allow.

- Maintain meaningful ownership through follow-on investments.

- Win competitive deals where founders want a partner capable of supporting them for multiple rounds of funding.

All of this is happening against the backdrop of a market that has reset from the 2021 peak. Deal volumes have fallen, particularly at seed and early venture stages, but overall investment levels remain robust. That combination, fewer deals, more selective capital, favours investors who can move decisively, offer substantial runway, and bring a differentiated proposition to founders.

So far in 2025, we’ve already delivered on this, with five profitable exits and five award wins in the industry. Those aren’t just vanity milestones; they’re evidence that a strategy built on regional opportunity plus co-investment firepower is working in practice.For investors, the conclusion is straightforward: capital may still be concentrated in London, but value creation isn’t. Haatch’s role is to bridge that gap, backing exceptional founders across the UK with bigger cheques, better runways, and a model designed to turn structural imbalance into long-term outperformance.