Latest. Updates, News

& Thoughts

The Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS) can be one of the most compelling, tax-efficient ways to invest. Generous tax reliefs combined with the potential for making substantial returns on your investment make the schemes premium products.

Fees in S/EIS exist to pay for the expertise, networks, and rigorous oversight that experienced fund managers bring to sourcing, backing, and guiding companies through to exit – work that is difficult to replicate as an independent investor.

What matters is how those fees are structured. Clear, transparent fees often signify a more principled fund manager. Integrity at the start is a strong indicator of honest communication when trusting someone with your investment.

In this article, I’ll break down how fees really work in EIS and SEIS, and offer practical pointers on what to look for when comparing fund managers, beyond just the surface-level costs.

Haatch’s approach to fees

At Haatch, we’ve built our model to be simple, transparent, and fully aligned with investor outcomes.

- We charge a single 10% initial fee, taken at subscription.

- There are no additional charges or fees deducted from the portfolio companies we back.

- Once your original capital across the portfolio is fully returned (gross of the initial fee), we charge a performance fee of 25% on gains above 1x, and 30% on gains above 5x.

This means Haatch only earns more when we’ve already delivered real growth for investors.

How Haatch compares in the market

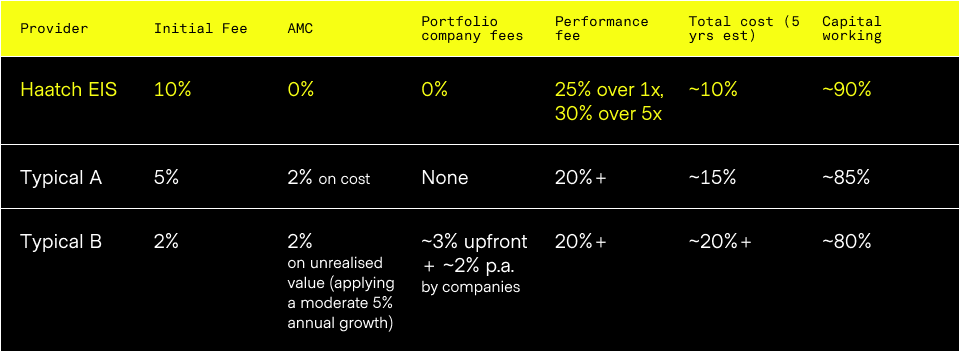

Fees across the S/EIS space can vary far more than they first appear.

MICAP’s 2025 data shows the average pre-exit fee across S/EIS funds is around 24%, while GrowthInvest names Haatch among the most transparent providers.

The table below demonstrates how low initial fees may be misleading, considering the actual capital working across a modest 5-year period:

Source: https://growthinvest.com/eis_funds/, July 2025

More capital stays working inside businesses with Haatch, and further fees only apply once real exits deliver actual investor returns.

Let’s look deeper: The different ways fees are charged

Fees in EIS and SEIS are generally taken in three ways:

- Directly from the investor, which is disclosed in the subscription paperwork.

- From the portfolio companies themselves, reducing the money they have to grow. Unlike investor fees, fund managers are not required to disclose portfolio company charges in key information documents under FCA/ MiFID II rules, as they are classed as ‘indirect fees’.*

*“Commercial companies are not subject to these costs and charges disclosure requirements.”- https://www.fca.org.uk/news/statements/statement-communications-relation-priips-and-ucits

- A combination of both is the most common model.

It’s easy to focus on what’s deducted from your investment upfront. But fees billed back to the companies also matter. Every pound taken from a portfolio company is a pound not used to hire staff, develop products, or open new markets. It can even influence which fund a founder chooses, with the best companies often favouring managers who leave them more working capital.

It’s also important to check how performance fees are applied. These can be charged in two main ways:

- On each individual company that exceeds a return, even if the rest of the portfolio underperforms or fails. This can significantly reduce overall returns, as investors pay success fees on isolated wins without considering the net outcome.

- On the portfolio as a whole, only occurring once the investor’s original capital has been fully returned. This approach aligns interests, ensuring performance fees are paid only when the combined investments have delivered actual growth.

All S/EIS fees types, and what to consider

A true comparison means looking beyond the headline figure. Here’s what to check:

- Initial fee: Taken upfront, reducing the amount that qualifies for tax relief. Haatch charges 10% and allows investors to gross up the investment to retain desired tax reliefs.

- Annual Management Charge (AMC): Typically around 2% each year. If charged on paper valuations, costs can grow even without exits. Haatch charges no AMC.

- Custody fee: Fees to the custodian or nominee. Haatch charges none.

- Dealing fee: Applied at purchase or exit. Haatch charges none.

- Other fees: Include audit, admin, and platform costs, which are often hard to see upfront. Haatch charges none.

- Portfolio company fees: Arrangement fees (3–6% on deployment), 2% annual monitoring, or £10,000–£30,000 deal costs billed directly to companies. Haatch does not charge portfolio companies.

- Performance fees: Taken on realised profits, typically after a 1x hurdle. It’s essential to check these aren’t stacked on top of years of AMCs, which risks paying twice — first on rising paper valuations, then again on exit. Also, clarify if fees apply to the overall portfolio (after full capital is returned) or on each company, which could mean paying performance fees even when total capital hasn’t been recovered due to losses elsewhere. Haatch charges 25% across the portfolio only if the full capital has been returned (1x), and 30% when we deliver 5x return, aligning us with investors’ return objectives.

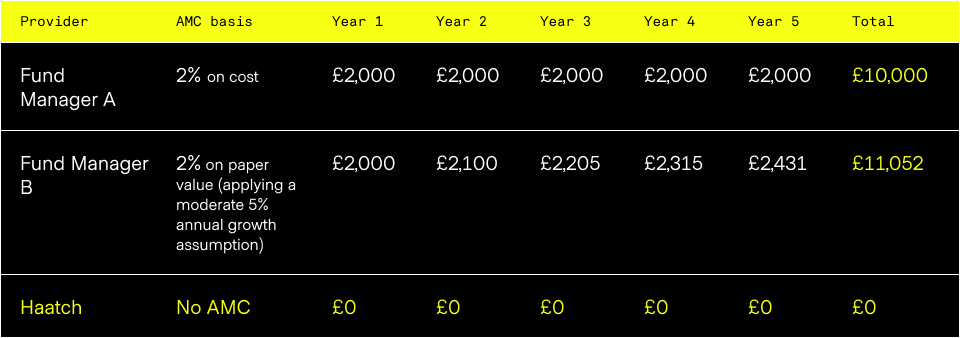

How AMCs quietly add up

Annual Management Charges (AMCs) can become one of the most significant long-term costs, especially if charged on the portfolio’s rising paper value.

Some managers apply 2% each year on the original investment, which is predictable. Others base this on the latest valuation, meaning fees climb even without cash returned. Here is an indicative example for comparative purposes only:

For investors, this often means paying thousands more in fees, even before any actual exits take place.

In summary

Fee structures shape outcomes just as much as the quality of the underlying investments.

At Haatch, investors know exactly what they’re paying. There are no hidden deductions from portfolio companies and no charges based on uncertain valuations. Additional fees only apply once genuine growth is delivered.

When choosing who to trust with your capital, transparency and alignment matter.

That’s why our model is designed to keep investor interests at the heart of every decision.

Written by Olivia Drinnan